What is the Next Disruptive Technology?

How can you determine if your company is at risk of

attack from a disruptive technology? How can you take advantage of the next

wave of business opportunities?

Clearly, if you can answer these questions you are

well on your way to becoming the next billionaire. Since finding the answers

will be challenging it is important to identify a process to review industries

and businesses and discover indicators that might identify opportunities.

Clayton Christensen’s theories on disruptive

technologies can provide some insights. His theories show that disruptive

technologies often are created when industry leaders’ products have been

improved to the point that a significant share of the market’s customers do not

want or need all of the product’s attributes. This allows a new market entrant

to provide a lower cost “good enough” product that doesn’t have all of the

“bells and whistles” of the industry leader’s product. This new entrant will

attract the least profitable customer of the industry leader and makes it

difficult for the industry leader to create strategies focused on its most

profitable customer (wants all the “bells and whistles”) and its least

profitable customers at the same time.

The new market entrant, as a result, is allowed to

grow its customer base until it overwhelms the market leader.

To use this principle to spot emerging opportunities

requires a bit of research and the ability to identify potential market

disruptions. The steps we recommend are as follows:

1)

Identify markets ripe for disruption. A market ripe for disruption is one where the

profits are very high and the mid to lower profit range customer base growth is

at a point where it is stagnating or possibly shrinking. This is an indication

that the products provided might have reached the point where customers may not

want or need all of the attributes offered or that the price is reaching an

unacceptable or unsustainable level. An example might be the health care

industry. Here the cost of medical care has gotten to the point that care

without insurance is difficult to afford. Further the costs are driving up

insurance costs to the point that insurance is difficult to afford. While the

total market for health care remains large and the demand is high, the lower profit

segment is stagnating and some are foregoing all but the critical health care.

2)

Identify new market entrants that are focused on the

industry’s least profitable customers.

New entrants would be providing products that are less expensive than those

provided by the industry leaders. For health care it might be the clinics

operated by nurses that are located in grocery stores and drug stores. Another

entrant for health care might be the telemedicine technologies that can provide

diagnosis and some treatment protocols via telecommunications. For retailers, a

disruptive technology was RFD mail delivery that spawned the catalog business

in the late 1800s.

3)

Make sure that the new entrants are disruptors. There are certain new technologies that might appear

to be market disruptors that are in fact a sustaining technology that can be

used by market leaders to better serve their best customers. The Internet, for

example, is considered a disruptive technology for the newspaper business. The

problem with this conclusion is that the Internet market entrants targeted the

newspapers’ most profitable customers. This, while in the short run, had a

significant impact on newspapers it also allowed newspapers the ability to

focus on counter strategies. That is, the new entrant didn’t focus on the least

profitable customers that would have created a dilemma for the newspapers to

have to abandon very profitable customers to protect a marginally profitable

customer base. The result is that newspapers and media companies have

integrated the Internet into their businesses and are beginning to develop new

digital strategies.

4)

Create an analysis that compares opportunities across

industries. There may be similarities

across industries that provide very large opportunities. RFD mail delivery

provided an opportunity for retailers to reach new communities by providing

non-custom, “good enough” wares to be ordered through the mail. This delivery

also allowed opportunities to printing, graphic and media industries. The

Internet has been a boon for social networking, search engine and retailing but

quickly became a key component for the delivery of new technology such as

telemedicine and energy production.

After going through this process there will be a

large number of choices and even the best analysis may result in a less than

optimal choice. The analysis will, however, likely increase the probability of

identifying a potential market disruptor.

My guesses for the next big disruptive technologies

are:

1)

Telemedicine –

new bioscience, telecommunication and digital technologies will provide the ability to deliver quality health care globally with

smaller facilities on site. The new technologies will include bio monitoring

and feedback, micro robotics and high resolution, 3D teleconferencing during

diagnosis and treatment.

2)

Energy –

Hydraulic fracking will continue to provide energy at lower costs. This

technology will allow expanded global manufacturing capabilities in the U.S. as

well as developing nations.

3)

Education –

Internet based college courses and degrees will increase and allow more

training that directly impacts career development. College degree costs will

drop and access to top tier universities will be available globally.

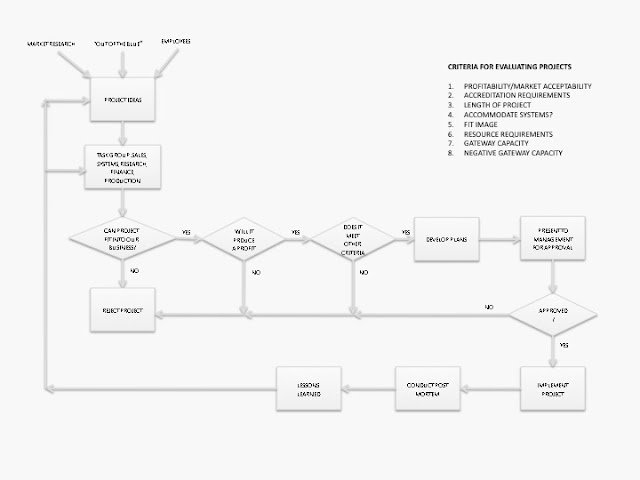

I am personally focused on telemedicine. In Houston, MD Anderson Cancer Center,

Rice University and the National Space Biomedical Research Institute have agreed to create

an eHealth Research Institute. This institute will review and vet telemedicine

projects that can advance the use of technology to deliver health care at a

distance. As projects are approved to be accepted for development the research

institute will seek funding for the project by attracting investment partners

that will participate in commercialization of the project’s products.

If you have an interest in learning more about the

eHealth research Institute or about becoming a project partner send me an email

at gary@gwrresearch that includes some background on you and your company.

Comments