Rethinking Tariffs Through the Lens of Productivity

I recently had an engaging conversation with a friend about the U.S. economy—specifically about tariffs and their potential effects on both the national economy and individual households.

My friend argued that tariffs would drive manufacturing back to the U.S., since importing goods would become more expensive. There's a kernel of truth in that: tariffs can make offshoring less attractive. But this view often overlooks the higher costs associated with domestic production, including building new facilities and paying U.S. wages. These increased costs may ultimately raise the prices of goods and services, fueling inflation.

There’s no question that certain strategically vital goods—such as those tied to national defense—should be manufactured domestically. Still, producing these goods on U.S. soil often comes with a price premium, which could lead to higher government spending and, possibly, higher taxes.

The conversation then shifted to immigration. My friend suggested that eliminating low-cost immigrant labor, combined with a tariff-driven increase in domestic jobs, would lead to better-paying jobs for American workers. But again, removing low-cost inputs (in this case, labor) and replacing them with higher-cost alternatives inevitably affects prices—unless productivity improves to offset those costs.

Let’s pause here and frame this discussion in economic terms, using the mathematical definition of productivity:

In simple terms, productivity increases when we either increase output or decrease input. The strength of the U.S. economy has long been rooted in its ability to do just that—produce more with less. Whether through innovation, automation, or efficient supply chains, American companies have historically been masters at boosting productivity.

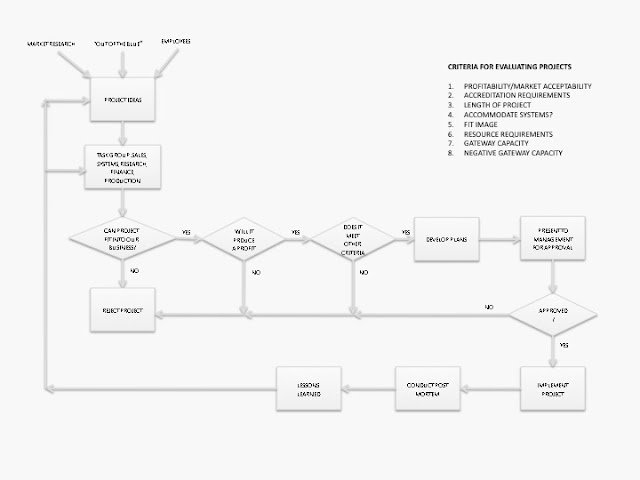

Businesses, like economies, are driven by this same equation. To remain profitable, a business must either:

Increase its output (revenue), or

Decrease its input (cost of goods, labor, materials, etc.)

When tariffs raise input costs—such as materials or labor—companies are forced to respond. Some pass costs on to consumers via higher prices. Others seek productivity gains through improved processes, technology, or automation. In the best-case scenario, companies become more efficient, preserving margins without inflating prices.

But there's a limit to how much businesses can absorb. If tariffs are too broad or applied without strategic analysis, they risk dragging down productivity. When applied thoughtfully, however, tariffs can protect industries essential to national interest and promote innovation. But this requires deliberate policy, not blunt instruments.

Toward the end of our conversation, I suggested that countries hit with high U.S. tariffs might simply seek new trade partners. My friend dismissed this, believing no economy could thrive without access to the U.S. market. I hope he's right—but it’s worth noting that the European Union and China each have GDPs approaching or rivaling that of the U.S.These are viable alternative markets for global trade realignments.

In conclusion, tariffs can be useful tools—if used strategically. But they must be viewed through the lens of economic fundamentals. When we apply the productivity equation—Output ÷ Input—we gain a clearer, more objective way to assess the potential impact of trade policies on businesses, consumers, and the broader economy.

Comments