Creating a New Business Using AI and MVOSSTE Part VI - Tactics

In Part V of our discussion of using AI and the MVOSSTE (Mission, Vision, Objective, Situation Analysis, Strategy, Tactics and Execution) framework we talked about the strategy as a combination of price, place, product and promotion (4Ps) to provide value for the company, the customers and the collaborators (3Cs).

AI, as was demonstrated in the examples, provides an assist in finding options for the 4Ps given the various needs of the 3Cs. It is a good idea to change scenarios and prompt AI to respond to each before deciding on the best combination of the 4Ps.

After the decision has been made on each of the 4P elements of your strategy, it is time to move on to developing tactics to deploy that strategy. Tactics refers to how you will deploy the strategy based on the resources that you will need. In the research or situation analysis section you should have determined specific audiences, specific market needs, a good understanding of the financial requirements and in the strategy phase you should have decided on specific product suites to offer.

Tactics is the sixth phase of the MVOSSTE framework and it requires the strategists and organizational leaders to consider resources as the are related to each of the 4Ps, The resources that should be considered are Workforce, Financial Resources, Operating Procedures and Fixed Assets. I refer to these as the manpower, money, methods and machinery that will be managed to deploy the strategy.

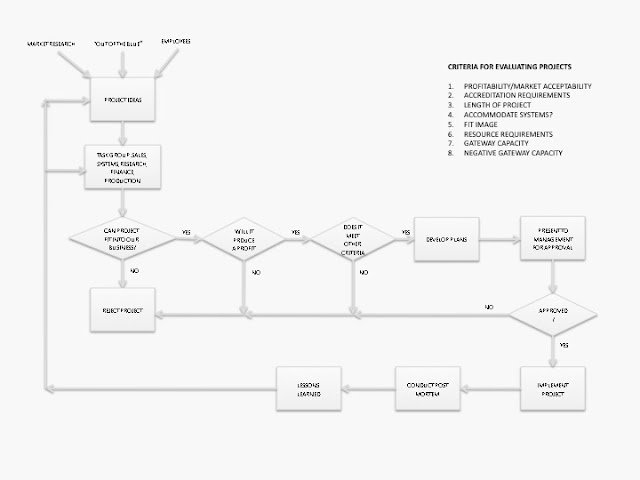

In the grid below the 4Ps are evaluated according to their ability to support the needed resources to deploy the strategy.

AI can be useful in providing options for tactics that might be used. Here is an example using the carrying case company we have used through the first 5 phases of MVOSSTE.

The price of your product directly impacts your ability to hire and retain a skilled workforce because it determines your gross margin, which funds operational expenses—primarily payroll.

Here’s how pricing influences workforce capacity:

🔁 1. Price → Gross Margin → Operating Budget

Higher prices (e.g., $129–$149) mean higher margins, giving you more flexibility to hire experienced professionals (e.g., marketing specialists, product designers, customer support leads).

Lower prices (e.g., $79–$89) shrink your margins, limiting cash available for salaries, training, and benefits—leading to:

Fewer hires

More reliance on freelancers or automation

Difficulty attracting top talent

📊 2. Scenarios: Price vs Hiring Capacity

| Price Point | Gross Margin/Unit | Break-Even Units | Workforce Implication |

|---|---|---|---|

| $79 | ~$49 | 3,061 | Bare minimum team, heavy outsourcing |

| $99 | ~$69 | 2,175 | Small in-house team, supplemented by contractors |

| $129 | ~$99 | 1,515 | Allows building core team with mid-level roles |

| $149 | ~$115 | 1,304 | Budget for strategic hires (e.g., Head of Ops, CMO) |

🎯 3. Workforce Needs from Tactics Plan

| Role | Est. Monthly Cost | Justification |

|---|---|---|

| Product Designer | $5,000 | MVP development, innovation |

| Marketing Lead | $6,000 | Customer acquisition, brand |

| Operations Manager | $5,500 | Fulfillment, logistics |

| Customer Support | $3,500 | Post-launch service |

| Freelance Creatives | $2,000 | Social content, UGC |

Total: ~$22,000/month ($264,000/year)

You’ll need at least $22k/month in margin just to cover core team salaries. That’s about:

320 units/month @ $69 margin

220 units/month @ $99 margin

✅ Conclusion

If your pricing is too low, even strong sales volumes may not generate enough margin to pay the team that will deliver the value your brand promises.

To employ a skilled, committed, and innovative team, aim for pricing that ensures 60–70% gross margins and keep your break-even point manageable.

To answer whether revenues cover the required cash flow needs for both operational and growth requirements, let’s analyze total cash inflow vs cash outflow under several pricing and sales volume scenarios.

🧮 Key Assumptions (from tactics plan + earlier data)

| Category | Estimate |

|---|---|

| Cost per unit (COGS) | $30 |

| Fixed monthly operating costs | $22,000 (staffing only) |

| Other fixed monthly costs | $5,000 (software, logistics, overhead) |

| Monthly growth investments | $5,000 (ads, R&D, outreach) |

| Total Monthly Cash Requirement | $32,000 |

| Pricing tiers | $79, $99, $129, $149 |

| Gross margins | $49, $69, $99, $119 respectively |

📊 Revenue vs Cash Flow Analysis

| Price | Margin/Unit | Units Needed to Cover $32K | Monthly Revenue at Break-Even Volume |

|---|---|---|---|

| $79 | $49 | 653 units | ~$51,587 |

| $99 | $69 | 464 units | ~$45,936 |

| $129 | $99 | 324 units | ~$41,796 |

| $149 | $119 | 269 units | ~$40,081 |

✅ Summary Insights

Yes, revenues can cover cash flow needs, if your price/margin is healthy and you consistently meet monthly sales targets.

However, low price/high volume scenarios (e.g., $79) create high risk if demand dips—even slightly.

Higher price points (e.g., $129–$149) provide more buffer for growth, unexpected costs, or reinvestment.

If you aim for $45K–$55K/month in revenue, you can cover:

Team salaries

Platform/operational costs

Growth initiatives

Still retain modest profit or cash reserve

🔁 Recommendation:

Launch at $99 or higher to ensure margins support operations.

Build demand early (via Kickstarter, B2B pilots, influencers) to hit 300–500 unit/month velocity.

- Reinvest part of early revenue into scaling team, inventory, and marketing.AI should be prompted to answer all of the sixteen squares before your analysis begins. Your analysis may find some discrepancies which will lead to further analysis. AI will certainly reduce the time of analysis, improve the ability to spot tactical inconsistencies and consider innovative solutions to the tactical challenges. For example, suppose that after mush discussion we find we need to reduce the price and this impacts our ability to have in-house employees with the needed competence. Using the prompt, "Assume the company must use the lower price ranges and therefore can't have the in-house employees with the needed competencies, Provide some solutions that would enhance profitability while maintaining quality and needed profit levels." AI offered the following solution:

If your company must operate in lower price ranges (e.g., $79–$99), limiting margins and preventing you from hiring full-time staff with the desired competencies, you can still maintain quality and profitability by optimizing your business model, operations, and partnerships.

Here are strategic solutions to enhance profitability without compromising quality:

✅ 1. Leverage Strategic Partnerships

Contract manufacturing with quality assurance built into SLAs to reduce production costs while maintaining standards.

Third-party logistics (3PL) to handle storage, fulfillment, and returns efficiently and at scale.

Freelance and agency support for marketing, design, and customer service using platforms like Upwork, Toptal, or Fiverr.

University collaborations or internships to access affordable talent with emerging skills in design, research, or digital marketing.

✅ 2. Outsource Critical Functions

Function Solution Product design Hire freelance industrial designers to develop cases and accessories Marketing Use performance-based digital marketing agencies Customer service Outsource to US-based virtual assistant firms with quality assurance Web dev/maintenance Contract out Shopify, WooCommerce, or other storefront setup and support This model keeps your fixed payroll near zero while preserving expert-level execution.

✅ 3. Implement Lean Operations

Use a build-to-order model or limited inventory drops to reduce unsold inventory risk.

Use pre-orders to fund production cycles and validate demand.

Launch on platforms like Kickstarter or Indiegogo to attract early adopters while raising working capital.

✅ 4. Enhance Unit Economics Without Raising Price

Bundle products (e.g., multiple sizes or accessories) to raise AOV without appearing expensive.

Reduce COGS through volume discounts, lower-cost but durable materials, and minimalistic design.

Introduce digital add-ons (setup guides, packing tips, apps) with zero marginal cost.

✅ 5. Differentiate on Brand, Not Price

Build a brand identity around functionality, sustainability, or inclusion to stand out in the market.

Target niche audiences (e.g., field technicians, traveling musicians) with specific use cases and testimonials.

Leverage user-generated content (UGC) to build community trust and credibility.

✅ 6. Automate & Digitize Where Possible

Use AI-powered tools for customer service (e.g., Chatbots, Zendesk automation).

Deploy automated email and SMS flows for onboarding, cross-selling, and retention.

Use low-code tools (e.g., Zapier, Airtable, Notion) to build systems without engineers.

🎯 Net Effect

Strategy Benefit Outsourcing Access expert talent without long-term cost Pre-orders Fund production without upfront capital Lean inventory Reduce working capital requirement Automation Minimize manual work while scaling Smart branding Justify premium perception at low cost Here is an analysis of the 16 squares generated by AI:Here's an assessment of the 16 strategic planning cells in your grid, with supporting solutions for each square that reinforce and align with the company’s goal of launching protective product solutions (e.g., carrying cases) on a limited budget, while maintaining quality, efficiency, and profitability.

🔷 OPTIMAL PRICE

Square Assessment Supporting Solution Workforce Limited in-house staff due to cost constraints Use freelancers or contractors on a per-project basis; tie compensation to performance or units produced Cash Requirements Lower prices yield thinner margins Implement dynamic pricing and volume-based discounts to boost margins while staying competitive Operating Procedures Pricing must support margin per unit Use contribution margin analysis to set sales and discount policies Fixed Assets Lower pricing means tight capital budgets Lease assets or use shared facilities to avoid large capital expenditures 🔷 OPTIMAL PLACE

Square Assessment Supporting Solution Workforce Proximity to logistics hubs can reduce costs Use contract fulfillment centers near major shipping zones Cash Requirements Location affects shipping cost and delivery time Use zone-based pricing and partner with 3PLs with scalable warehousing Operating Procedures Place drives storage and inventory costs Use demand forecasting and JIT inventory to reduce footprint and overhead Fixed Assets Need minimal and productive footprint Consider co-warehousing or flexible pop-up distribution spaces 🔷 OPTIMAL PRODUCT

Square Assessment Supporting Solution Workforce Specialized design and materials expertise is needed Partner with product engineers or industrial designers on a contract basis Cash Requirements High-quality materials can strain budget Use modular or scalable design to control COGS and allow upsell variants Operating Procedures Production efficiency is essential Standardize SKUs and reduce variation to streamline production and QC Fixed Assets Manufacturing assets may be out of reach Outsource production to reliable third-party manufacturers with QC control built in 🔷 OPTIMAL PROMOTION

Square Assessment Supporting Solution Workforce In-house marketing may not be affordable Use low-cost UGC, influencers, and affiliate programs Cash Requirements Marketing spend competes with operations Adopt performance-based marketing (e.g., pay-per-sale), use freemium PR Operating Procedures Promo must be agile and data-driven Automate email flows, use A/B testing, track CAC/ROAS in dashboards Fixed Assets Promotion assets (studio, tools) can be expensive Use online design tools (Canva, Figma), royalty-free stock, and creator partnerships for content creation 🔗 Cross-Cell Reinforcements (Examples)

Price ↔ Product: Smart bundling can raise price without increasing COGS significantly, helping achieve profitability even with lower base pricing.

Place ↔ Workforce: Co-locating contract workers with third-party logistics partners improves operational synergy.

Promotion ↔ Cash Flow: Low-cost digital channels (e.g., email and SEO) provide ongoing traffic without ongoing ad spend.

Product ↔ Fixed Assets: Contract manufacturing with volume thresholds avoids CapEx, while maintaining quality and flexibility.

As you can see Ai can be very helpful in providing answers to well directed queries or prompts. After analyzing all 16 squares on the grid and addressing any inconsistencies with resources required to mov forward, you have identified the manpower, money methods and machinery that will be needed to deploy the strategy. At this point you should have a mission, vision, objective, supporting research, strategy and tactics for your new carrying case business. The next step will be execution which will be the actions to successfully launch the business strategy utilizing the tactics you have identified. Execution will be covered in the next post.

Comments